Intermodal Logistics Centers Can Drive Increase in Industrial Property Values Along High Capacity Trucking Highways

Intermodal Logistics Centers Can Drive Increase in Industrial Property Values Along High Capacity Trucking Highways

The presence of an intermodal logistics center (ILC) can result in higher property values for industrial properties on or near state highway routes or near roads close to interstate highway interchanges.

That’s the key conclusion from a research report that analyzed the economic impact of the CenterPoint Intermodal Center on industrial properties in parts of Will County, Illinois.

The report, “Intermodal Logistics Centers and Their Impact on Transportation Corridor Industrial Property Value,” was completed by researchers at the Urban Transportation Center (UTC) at the University of Illinois at Chicago.

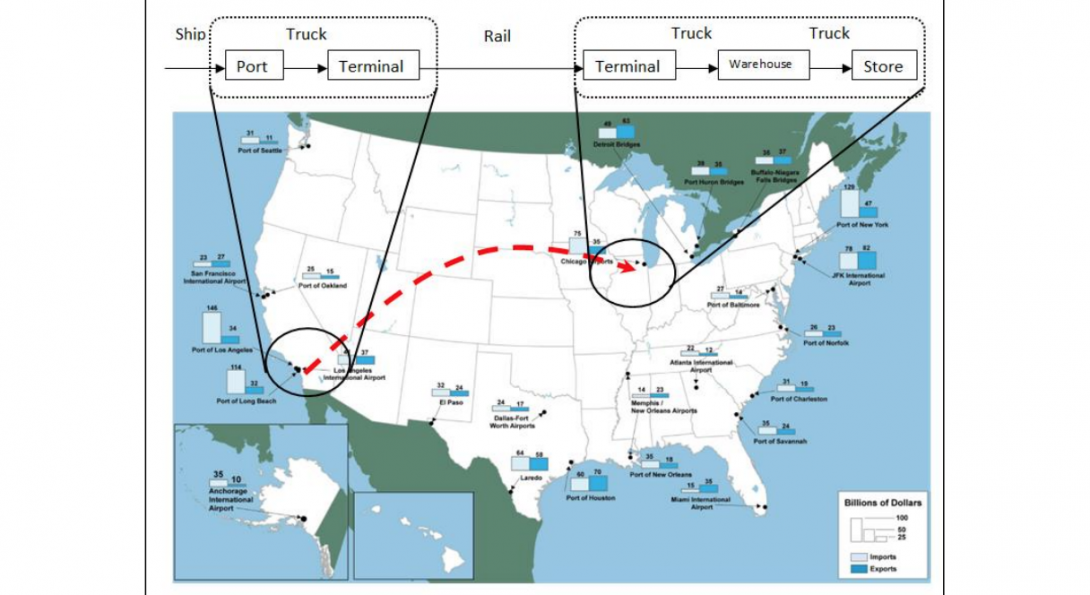

Researchers used tax assessment, truck volume and U.S. census data from 2002 to 2007 to analyze patterns and property value changes of industrial property along trucking and waterway corridors close to CenterPoint, a master-planned inland port located on 6,500 acres 40 miles southwest of Chicago. Located in Elwood, CenterPoint was built between 2000 and 2002 with tax increment financing from the Village.

Those roadways studied as part of a treatment group showed an increase in equalized assessed value (EAV) per square foot by $0.25 over properties studied in a control group. The treatment group, located on the west side of Will County, was comprised of properties on or near Interstate 55, Interstate 80, State Route 53, and a waterway — the Des Plaines River/Chicago Sanitary Ship Canal. Properties studied in the control group, located on the eastern side of the county, were on or near Interstate 57, State Route 50 and U.S. Route 45.

The treatment group transportation corridors are located close to CenterPoint, while the control group does not have an ILC in close proximity to its transportation corridors.

When analyzing surface streets, researchers learned that treatment group surface streets increased in EAV per square foot by $0.28 more than the control group surface streets.

The future completion of a major ILC like CenterPoint was cited as one possible factor behind the increase in property values in the treatment group, the report stated. “While this study does reveal significant differences in EAV per square foot before and after the establishment of a major intermodal logistics center, speculation of industrial land could have inflated prices before 2002.”

The reports also states that future ILC developments could benefit from value capture practices – a process where funding is secured from additional taxes or predetermined grants from developers of properties that stand to benefit from the investment road improvements or other public resources.

“In accordance with these findings, planners should consider value capture tools along trucking corridors,” the report stated. “Increases in industrial property value and should be considered with projects that involve an intermodal logistics centers.”

Visit this page to download the complete “Intermodal Logistics Centers and Their Impact on Transportation Corridor Industrial Property Value” report.