Value Capture Coordination: Case Studies, Best Practices and Recommendations

Research from the Urban Transportation Center at UIC Incorporates Case Studies in San Francisco, Washington, New York & Chicago

Capital transportation projects can be funded in part through a process called “value capture” if local governments, transportation authorities and private development companies initiate the concept in the very early planning stages.

This is a key finding from recent research conducted by the Urban Transportation Center (UTC) at the University of Illinois at Chicago on the viability of value capture, defined as a way to increase the value of properties near major infrastructure improvements, like transit lines.

The report, “Value Capture Coordination: Case Studies, Best Practices and Recommendations,” also states that transit systems in large metropolitan markets with many yet-to-be-funded transportation construction or expansion projects are being encouraged by the federal government to explore value capture to meet funding needs.

Through value capture, funding is secured in the form of additional taxes or predetermined grants from the developers of properties that stand to benefit from the investment in public resources.

A team of researchers from the UTC conducted field research in 2013 and 2014 in four major U.S. cities and learned that the incorporation of value capture to fund transportation differed, often dramatically, in the markets studied.

Here’s an analysis of the four case studies:

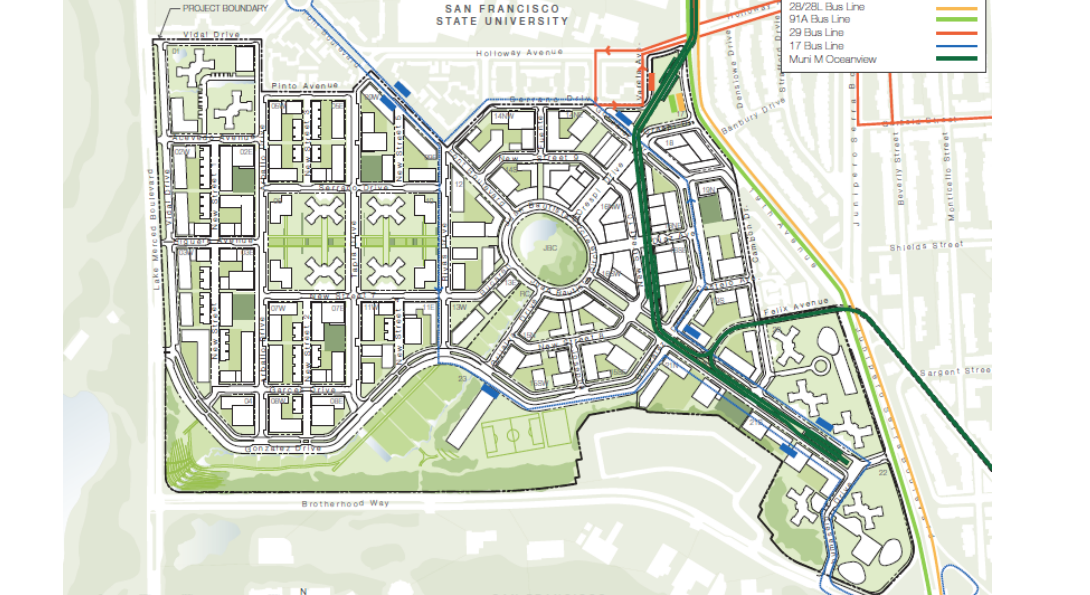

San Francisco, Parkmerced. This case study centered on the prospect of using value capture as a way to fund a new station and expanding service on the Muni M Line in San Francisco to better serve residents of Parkmerced, a large multi-family residential development, and the nearby San Francisco State University. Since 2006, more than 500 meetings were held between local and regional governments, Bay Area transit agencies and various community and advocacy groups and the new owners of Parkmerced. Funds for continued study and the new station were secured from community groups and the university.

Key conclusions:

- Outstanding coordination between the existing transit agencies and City staff were vital to the project’s success.

- The large number of planning meetings lent credibility when public agencies approached developers around contributions.

Washington, D.C., NoMa-Gallaudet U. In 1999, the Washington Metropolitan Transit Authority identified the need for a new rapid transit station between Union Station and Rhode Island Avenue on the Red Line. Developers and local land owners were brought into the planning process shortly after the project was announced, and community groups helped communicate with the private-sector interests. The private sector agreed to creation of a Special Taxing District that generated $25 million, or roughly one-quarter of the total cost of the station, which opened in 2004.

Key conclusions:

- Engaging the development community early and involving a private civic group called Action 29 was imperative to secure funding.

- Value capture does work when all parties are on board with the process. Since 2004, there has been $3 billion of private investment near the station.

New York, Hudson Yards. Redevelopment of the Hudson Yards, a 45-block parcel on the west side of Midtown Manhattan, prompted the city to push for extending the Number 7 subway to the area. The project cost was estimated at $2.3 billion. Two separate planning entities were created – one to control funding and financing, the other the city’s development plan. Rezoning in the area allowed developers to pay a premium to build higher density properties; these funds, plus tax increment financing, will support debt financing.

Key conclusions:

- Close cooperation with the New York Metropolitan Transit Authority was critical to the success of this value capture project.

- Creation of the two planning agencies established a benchmark and unprecedented new way to manage value capture funding.

Chicago, CTA rapid transit stations. Like most older cities, Chicago has extensive transit capital improvement needs. A total of 153 tax increment financing districts (TIF) are in place, and this form of value capture is used to help fund redevelopment projects at Chicago Transit Authority rapid transit stations. In this case study, the researchers studied how TIF funds were used to improve six CTA rapid transit stations, where the ratio of value capture to total budget ranged from 2% to 100%. Unlike the other three examples, TIF funds are not as project specific.

Key conclusions:

- There are opportunities in Chicago to expand the use of other transit-specific value capture mechanisms.

- Chicago developers are open to discussion value capture options.

Read an abstract and download the complete “Value Capture Coordination: Case Studies, Best Practices and Recommendations” report. This research was funded by CN Railway, National University Rail Center (NURail) and the Center for Urban Transportation Research.